What's New

News

Common Reporting Standard

We are Murata Sogo Tax Accountant Office, specializing in international taxation and asset taxation.

Today, we would like to introduce CRS.

1. Overall

CRS is an abbreviation for Common Reporting Standard. It is a standard established by the OECD to combat international tax evasion and avoidance through the use of foreign financial institutions. In accordance with this standard, financial institutions in each country report the account information of non-residents to the tax authorities in their country. Upon receipt of the report, the tax authorities automatically exchange the information with the tax authorities of the non-resident's country. In Japan, Japan taxation has been reformed by the tax reform of the fiscal year 2015, and when opening a new account at a financial institution, etc. on and after January 1, 2017, a notification form stating the name, address or head office address, date of birth for individuals, and country of residence for tax purposes must be submitted to the financial institutions.

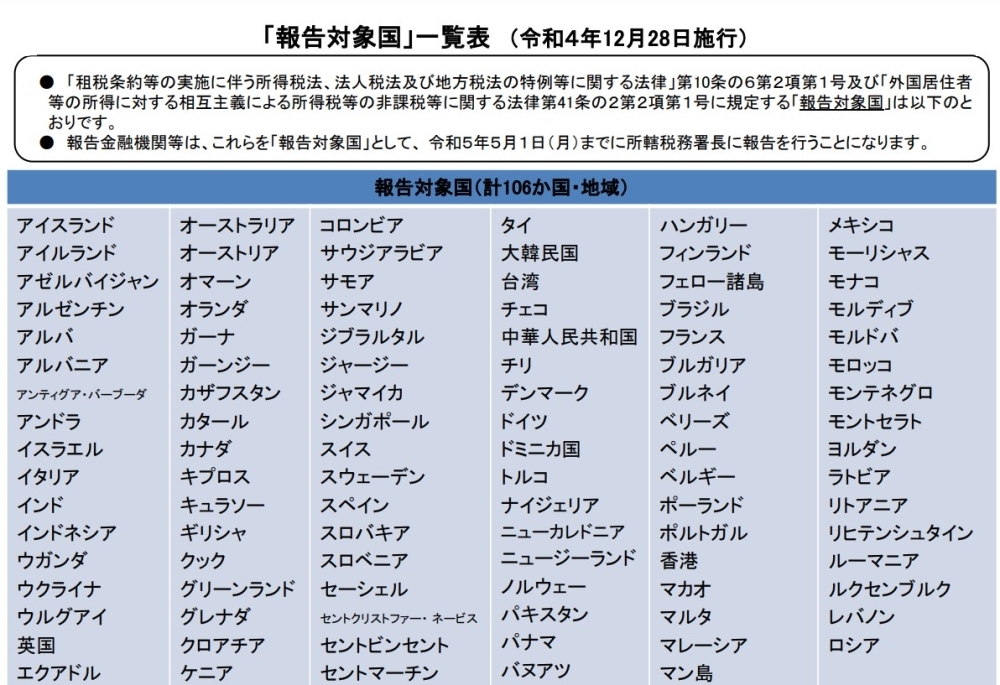

2. Covered Countries

出典:国税庁ホームページ(https://www.nta.go.jp/taxes/shiraberu/kokusai/crs/pdf/crs_country.pdf)